您的生活指南

- 务实的基于证据的指南,过上更可持续的生活

- 如何利用可再生能源和最新技术为我们的星球创造更美好的未来

- 无偏见的建议,没有公司超载或绿色

太阳的

必威aqq

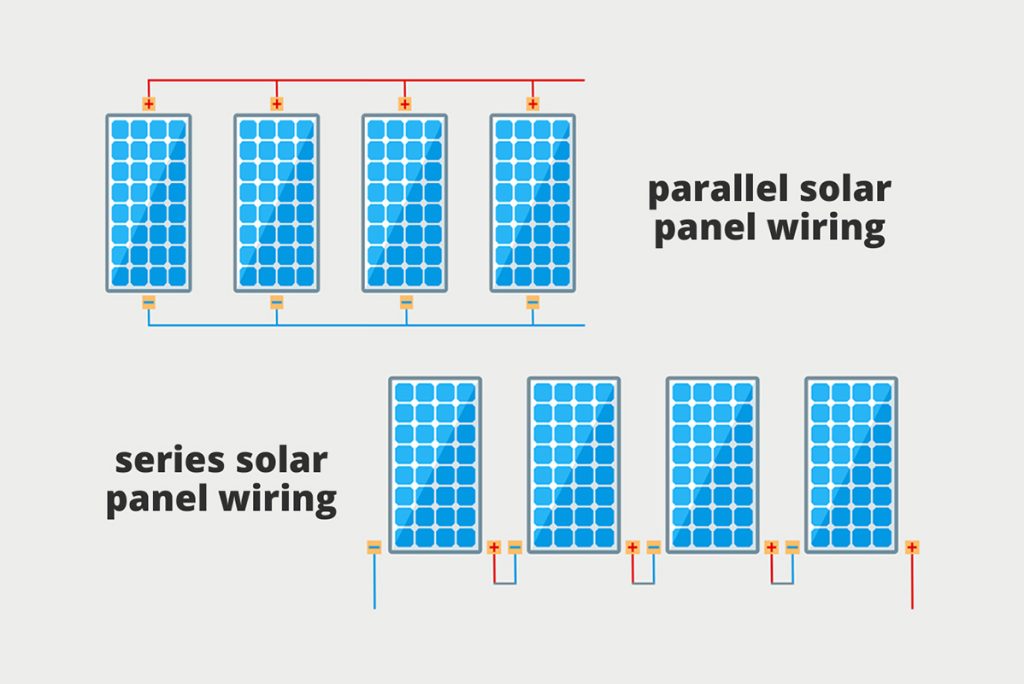

太阳能电池板接线的基本指南:平行VS。系列vs。系列并联连接

将太阳能电池板连接在一起的最佳方法是什么?在串联,并行还是平行组合中?在这里找出您需要知道的一切 - 以及如何吓到它。

Agrivoltaics:关于将农业与太阳能农场相结合的农民和牧场主指南必威体育官网下载app

必威体育官网下载app随着对可再生能源的需求的增加,太阳能农场正在席卷整个国家。随着他们的流行,一场食物与能源之战。这是避免在您自己的土地上避免这种困境的方法。

零废物

必威备战

什么是零废物?如何削减产生的废物

如今,“零废物”是一个术语,就像“可持续”和“环保”。你…

大麻厕纸:您应该切换的7个原因

如今,产品由多种不同的材料制成。其中一些是全新的,而另一些是……